Introduction to Cross-Chain Transactions

In the rapidly changing domain of blockchain technology, cross-chain transactions have emerged as a significant evolution, allowing interaction and collaboration across a variety of blockchain systems. As the environment expands with numerous platforms, the capability to seamlessly perform transactions between chains without the need for intermediaries becomes a critical necessity for boosting the effectiveness and fluidity of digital assets. Cross-chain transactions are fundamental to the structure of Decentralized Finance with Hop Exchange, wherein the need for broad and rapid transactions exceeds traditional blockchain constraints.

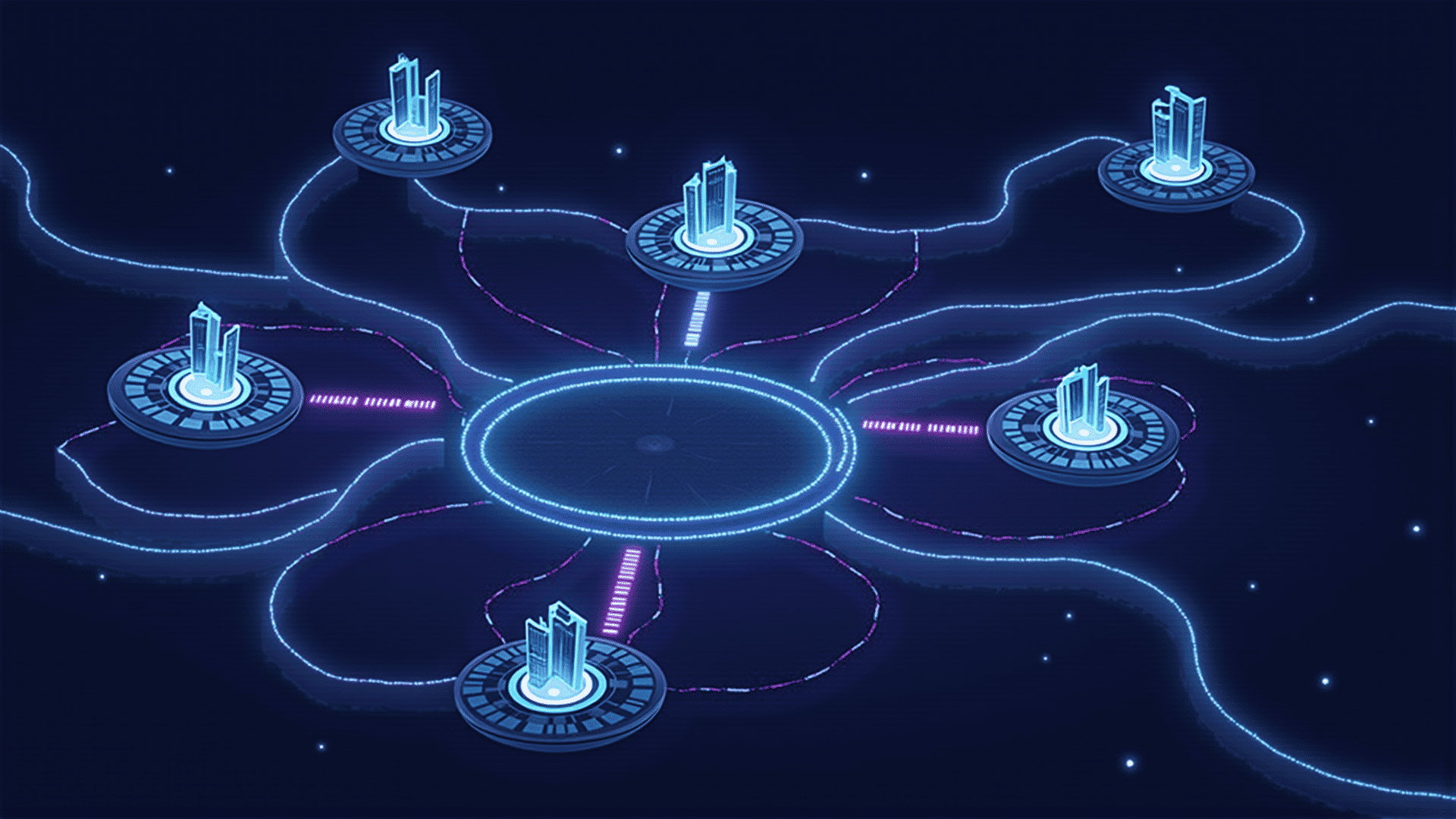

The core of a cross-chain transaction is the attempt to break down the conceptual barriers separating blockchain networks, forming a network of interconnected yet independent platforms. This technological advancement is achieved through sophisticated protocols and utilizing innovative mechanisms such as atomic swaps, relays, and cross-chain bridges. These strategies open the door to a more integrated blockchain economy, where value is not confined within individual ecosystems but can move as a fluid, dynamic entity across various decentralized ledgers.

The significance of cross-chain transactions within DeFi is substantial. As DeFi platforms grow, the ability to engage with multiple blockchain ecosystems with rapid efficiency becomes vital. Cross-chain interoperability not only enhances the scalability of DeFi protocols but also encourages the inclusion of a broad spectrum of digital assets, thereby boosting liquidity and creating opportunities for new financial instruments.

In conclusion, cross-chain transactions represent the shift from isolated blockchain systems to an interconnected, multi-chain universe, which offers great potential for the future of decentralized finance and beyond. As stakeholders and developers continue to advance and innovate cross-chain capabilities, it will usher in an era where blockchain interoperability is not merely an additional aspect but a central tenet of the digital asset framework.

The Mechanics Behind Cross-Chain Transactions

In the complex domain of blockchain, cross-chain transactions represent the zenith of interconnectivity, revealing a blend of varied blockchain networks that transfer digital assets beyond their native confines. These exchanges are powered by cutting-edge technology and protocols that exceed the standalone characteristics of individual blockchains. At the core of this interoperability issue are breakthroughs like atomic swaps, which enable a mutual exchange between distinct blockchains without needing an intermediary entity. Through cryptographic methods, atomic swaps guarantee trust-free transactions, using hashed time-locked contracts (HTLCs) to reduce risks associated with cross-chain exchanges.

Furthermore, the emergence of connectivity protocols such as Polkadot and Cosmos has propelled the growth of cross-chain transactions, providing a structure where multiple chains integrate through interconnecting hubs. These protocols employ bridging techniques like Inter-Blockchain Communication (IBC), allowing disparate networks to interact seamlessly, thus fostering unrestricted circulation and modification of data and value.

Additionally, the ecosystem witnesses the integration of blockchain oracle systems, acting as intermediaries that extend the computational capabilities of smart contracts by enabling them to incorporate external data. Such oracles play an essential role, particularly in situations where composite transactions must interface with external data sources, further enhancing the precision and scope of cross-chain activities. Through the coordination of these sophisticated technologies and protocols, the realm of cross-chain transactions transcends its limitations, unlocking a world of possibilities where digital assets and decentralized applications interweave through an integrated blockchain network.

Role of Hop Exchange in Facilitating Transactions

Hop Exchange plays an essential role in the field of cross-chain transactions by greatly enhancing their efficiency and security. As the decentralized finance (DeFi) landscape expands, the requirement for smooth interactions between various blockchain networks has never been more critical. Hop Exchange functions as a bridge, allowing the fast and trustworthy transfer of assets across blockchains, thus reducing the common delays that typically obstruct such operations.

An impressive feature of Hop Exchange is its adoption of an innovative protocol that reduces the complexity often encountered in multi-network transfers. By employing a robust system that directs transactions through intermediaries known as liquidity providers, the platform facilitates near-instantaneous asset swaps. This not only improves transaction speed but also lowers the chances of congestion, which are usual in traditional cross-chain techniques.

Security forms the cornerstone of Hop Exchange's architecture. It uses state-of-the-art cryptographic methods to maintain the integrity of transactions, ensuring that assets stay protected during transfers. The platform implements advanced security measures embedded in its functions, giving users confidence that their holdings are safeguarded against the common vulnerabilities in cross-chain interactions.

Furthermore, by lessening the need for middlemen and relying on automated smart contracts, Hop Exchange reduces the risk associated with human error or fraudulent actions. This self-governing approach provides a higher level of transaction finality and dependability, establishing Hop Exchange as a strong player in the domain of decentralized cross-border exchanges.

In brief, Hop Exchange's strategy demonstrates a sophisticated combination of speed and security, making it a keystone for individuals looking for trustworthy cross-chain operations. As blockchains continue to grow in number, the integrated solutions offered by platforms like Hop Exchange are essential in fostering a more unified and secure DeFi ecosystem.

Benefits of Efficient Cross-Chain Transfers

The realm of blockchain technology is frequently beset by fragmentation, with numerous distinct networks functioning autonomously. This separation can significantly hinder those attempting to take advantage of the complete spectrum of decentralized finance possibilities. Enter adept cross-chain transfers, a technique that can simplify complexities and usher a new era of interoperability. By enabling smooth transactions of assets and data across varied blockchain domains, these sophisticated transactional methods offer numerous benefits that could transform user experiences and ecosystem interactions.

Leading these benefits is increased liquidity. Users can effortlessly transfer digital assets across various platforms without the cumbersome process of token exchanges or reliance on centralized exchanges, liberating capital flow from conventional limitations. Skilled cross-chain mechanisms thereby democratize access to a wide range of decentralized applications, fostering a dynamic and cohesive digital marketplace.

Another benefit is the decrease in transaction costs. Cross-chain technology removes the necessity for intermediaries and often uses lower fees on less congested networks to enhance transactions. This cost-effectiveness allows users to transact more freely, promoting a thriving ecosystem where unrestricted exchanges are the standard rather than the anomaly.

Moreover, these transactions address scalability issues. With the ability to distribute load across multiple blockchains, efficient cross-chain transfers alleviate congestion problems related to any single network. This decentralization of transaction management can considerably increase throughput, laying the foundation for a robust, high-capacity blockchain infrastructure ready to support widespread adoption.

The potential for groundbreaking innovations represents another incomparable advantage. By connecting previously isolated networks, developers gain access to a broader array of blockchain features and services. This cross-pollination ignites inventive new applications that leverage the unique characteristics of multiple platforms, fostering a varied range of solutions that address users' diverse needs more comprehensively.

In summary, adept cross-chain transfers not only dismantle existing obstacles within the blockchain sector but also invigorate it with liquidity, financial advantages, scalability, and unlimited opportunities for innovation. These benefits suggest a transformative evolution that could seamlessly integrate disparate chains into a unified, interconnected network capable of meeting the intricate demands of the future digital economy.

Future of Cross-Chain Transactions

As the blockchain ecosystem continues to evolve, the trajectory of cross-chain transactions persists as a pivotal point of progress. The impending landscape of these transactions hinges on a fusion of technological breakthroughs and user appetite for seamless interoperability across distinct blockchain networks.

One of the most eagerly awaited shifts in this field is the evolution of interoperability protocols that enable disparate blockchain networks to communicate more effectively. These mechanisms, often dubbed 'blockchain bridges,' are establishing fresh benchmarks for liquidity and efficiency by facilitating token transfers and smart contract executions across chains without reliance on a central authority. The principal aim is to diminish fragmentation within the blockchain sphere through the enhancement and acknowledgment of these bridges, thereby cultivating a more cohesive and integrated financial ecosystem.

Furthermore, another budding facet is the refinement of cross-chain atomic swaps, which are set to transform the exchange of cryptographic assets. By allowing direct peer-to-peer exchanges without intermediaries, atomic swaps foster a trustless setting for asset transfers, thus enhancing security and reducing transaction costs. The emergence of Layer 2 solutions is further bolstering the scalability of these swaps, paving the way for broader adoption.

Moreover, the convergence of decentralized finance (DeFi) applications with cross-chain capabilities is poised to unlock extraordinary synergies. This merger would enable users to leverage assets on one blockchain to engage in Decentralized Finance with Hop Exchange pursuits on another, thus crafting a myriad of opportunities for income generation and portfolio diversification.

In harmony with these advancements, the role of governance mechanisms within cross-chain domains is becoming increasingly paramount. As ecosystems grow more intricate, the prominence of decentralized autonomous organizations (DAOs) in administrating and harmonizing cross-chain operations is expected to expand, ensuring participatory involvement in protocol enhancements and mitigating risks linked to centralized control.

As we look toward the future, it is clear that the evolutionary path of cross-chain transactions will continue to be molded by technological innovation and strategic alliances among blockchain trailblazers. This advancement is poised to introduce a groundbreaking era of interconnectedness that surpasses the boundaries of isolated blockchain environments, heralding a more adaptable and dynamic digital financial framework.